Was one of your resolutions for 2018 to get more organized? If so, you’re in good company. Getting organized is among the most popular New Year’s resolutions.

Even if you didn’t expressly resolve to get more organized, you may have done so without realizing it via your other resolutions. This is because organization is key to success with so many goals.

Say for example that you resolved to spend more time with family, or achieve a fitness goal, or tackle debt. Being more organized means that you can gain time to enjoy family. Fitness goals are more attainable when you have fewer barriers between you and your workout – if it’s hard to find those workout clothes, it’s that much easier to throw in the towel and not work out.

If your goals are financial, an organized mail and paper management system can be like found money. You can pay down debt instead of paying late fees after you finally come across that overdue bill. Organization really is crucial to achieving most goals.

Resolutions are easy to make and all too easy to break. New Year’s resolution expert John Norcross found that 25% of us don’t stick with our New Year’s resolutions past the first week. If you are still on track with your New Year’s resolution, kudos! If not, now is the perfect time to reset.

Resetting your resolution may be as simple as breaking it down into small steps. Have you written down your resolution? If not, try that. People who write down their goals have been found to accomplish significantly more than people who don’t. It may be a matter of reworking your resolution so that it’s S.M.A.R.T. (Specific, Measurable, Achievable, and Relevant / Realistic, and Time-bound).

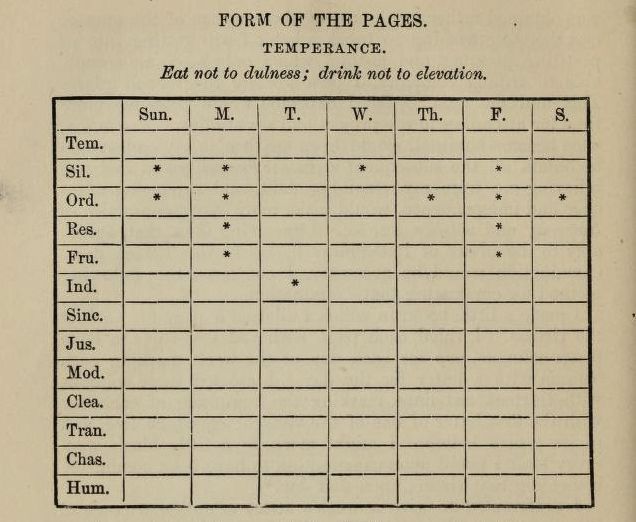

Change that involves organization can be hard for the best of us no matter what strategies we try. If this sounds like it applies to you, you’re still in good company.  Consider that Benjamin Franklin made a chart of 13 “virtues” to which he aspired. Order was the one he struggled most with, according to the chart he included in his Autobiography. He would put a mark on those days when he did not achieve the virtue, and there are more marks for order than for any other virtue.

Consider that Benjamin Franklin made a chart of 13 “virtues” to which he aspired. Order was the one he struggled most with, according to the chart he included in his Autobiography. He would put a mark on those days when he did not achieve the virtue, and there are more marks for order than for any other virtue.

If you can relate to Franklin’s struggles, consider an option that didn’t exist in Franklin’s day: hire a professional organizer!

Purging is an often recommended and common sense first step to organizing. When we’re dealing with documents, most of us aren’t always sure what to toss, what to keep and for how long. Here are some guidelines to get you started on handling common types of documents. Your situation may be more complex, if, for instance, you have chronic health problems, or have a business. When in doubt, ask an accountant, attorney, daily money manager, or other trusted professional. When it comes to those documents that you should keep, consider that most of the documents can be scanned and the hard copies discarded.

TOSS

KEEP SHORT TERM

KEEP LONG TERM

KEEP PERMANENTLY